- You are here:

- Home

- > Publications

- > Regional Labour Market Statistics, February 2013

Statistical bulletin: Regional Labour Market Statistics, February 2013

Contents

Key points

- Employment rate highest in the South East (75.0%) and lowest in the North East (67.7%).

- Unemployment rate highest in the North East (9.7%) and lowest in the South West (5.5%).

- Inactivity rate highest in the North East (24.9%) and lowest in the East of England (19.6%).

- Claimant Count rate highest in the North East (7.7%) and lowest in the South East (3.0%).

In this bulletin:

This bulletin shows the latest key labour market statistics for the regions and countries of Great Britain along with statistics for local authorities, travel-to-work areas and parliamentary constituencies.

Data for Northern Ireland are available separately.

Updated this month

Labour Force Survey estimates for the period October 2012 to December 2012.

Claimant Count for January 2013.

Also in this release

Workforce Jobs estimates for September 2012.

Annual Population Survey estimates for the period October 2011 to September 2012.

Overview of regional labour market statistics published 20 February 2013

The employment rate for those aged 16 to 64 for the three months to December 2012 compared to the three months to September 2012, showed large increases for a couple of regions of the UK.

The largest increase was for the West Midlands which increased by 1.2 percentage points.

Despite a few regions showing decreases between the estimates for the three months to September and December, the general pattern for most regions are either increases in the employment rate, or for the rate to be flat. Yorkshire and The Humber, the West Midlands and London in particular have been showing a general pattern of increase in the employment rate recently, with increases over the past year being statistically significant.

Employment rates remain higher in the South East at 75.0%, East of England at 74.8% and South West at 74.7% than the rest of the UK.

The employment levels for the West Midlands, East of England and London are all at record highs, although the rates remain below record levels due to increasing population numbers.

Regional figures for the unemployment rate are quite volatile, which needs to be allowed for when considering the pattern of change over time.

None of the changes in the unemployment rate for the three months to December 2012 compared to the three months to September 2012 were particularly large.

The unemployment rate for the North East at 9.7 % continues to be the highest in the UK.

Where employment rates are increasing it is often being accompanied by falls in the rates for economic inactivity rather than strong falls in unemployment rates. Economic inactivity rates for London and the West Midlands are at record lows, with a number of other regions close to that mark.

The Claimant Count has fallen across all regions in the United Kingdom, except for Northern Ireland where it has remained unchanged. This is the first time that the Claimant Count has not increased in Northern Ireland since December 2011.

Employment

The employment rate for people aged from 16 to 64 for the UK was 71.5% for the period October 2012 to December 2012.

The region with the highest rate was the South East at 75.0%, followed by the East of England at 74.8% and the South West at 74.7%. The region with the lowest rate was the North East at 67.7%, followed by Wales at 68.6% and the North West at 69.8%.

The regions with the largest increase in the employment rate on the previous period (July 2012 to September 2012) was the West Midlands with an increase of 1.2 percentage points followed by London with an increase of 0.6 percentage points. The region with the largest decrease in the employment rate was Wales with a decrease of 0.4 percentage points. The UK rate increased by 0.3 percentage points.

Figure 1: Employment Rates, October 2012 to December 2012, Seasonally Adjusted

Download chart

-

XLS format

(17 Kb)

Over the year the regions with the largest change in the employment rate were London with an increase of 2.8 percentage points, followed by the West Midlands at 2.7 percentage points and Yorkshire and The Humber at 2.1 percentage points. Scotland was the only region to see a decrease at 0.1 percentage points.

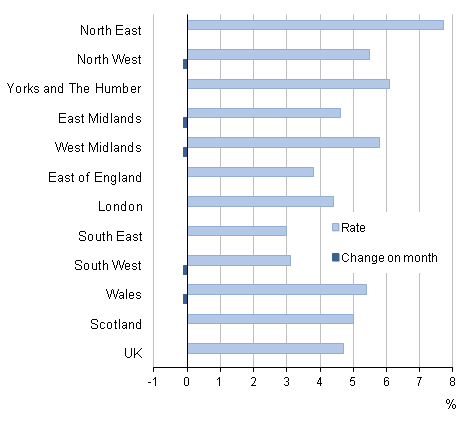

Unemployment

The unemployment rate for people aged 16 and over for the UK was 7.8% for the period October 2012 to December 2012.

The region with the highest rate was the North East at 9.7% followed by Yorkshire and The Humber at 8.9% and West Midlands and Wales both at 8.6%. The region with the lowest rate was the South West at 5.5%, followed by the South East at 6.5% and the East of England at 6.8%.

The regions with the largest decrease in the unemployment rate on the previous period (July 2012 to September 2012) were Scotland at 0.4 percentage points followed by London at 0.3 percentage points. The unemployment rate in Wales increased by 0.4 percentage points followed by the South East and the North West which both increased by 0.1 percentage points. The UK rate decreased by 0.1 percentage points.

Figure 2: Unemployment Rates, October 2012 to December 2012, Seasonally Adjusted

Download chart

-

XLS format

(17 Kb)

Over the year the regions with the largest changes in the unemployment rate were London with a decrease of 1.6 percentage points, the North East with a decrease of 1.5 percentage points and Scotland and Yorkshire and The Humber with a decrease of 0.9 percentage points.

An interactive chart showing regional unemployment rates over time is available.

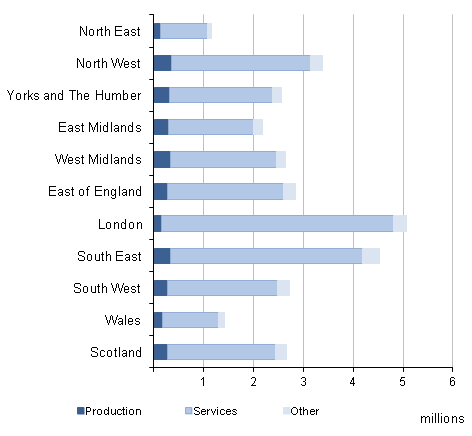

Workforce Jobs

Workforce Jobs increased in 7 of the 11 regions of Great Britain between June 2012 and September 2012 with a decrease in other 4 remaining regions. The largest increase of 41,000 was in Yorkshire and The Humber, whilst the largest decrease of 39,000 was in the East Midlands.

The East Midlands had the highest proportion of jobs in the production sector at 13.8 % whilst London had the lowest proportion at 3.1 %. For the service sector London has the highest proportion at 91.7 % whilst Wales has the lowest at proportion at 78.5 %.

Figure 3: Workforce Jobs by broad industry group, September 2012, Seasonally Adjusted

Download chart

-

XLS format

(21.5 Kb)

Jobseeker’s Allowance

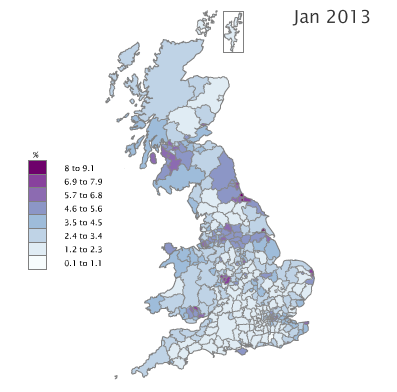

The seasonally adjusted claimant count rate for the UK was 4.7% in January 2013 unchanged from December 2012, although the level was down 12,500.

The region with the highest rate in Great Britain was the North East at 7.7%, unchanged from the previous month. The next highest rates were in Yorkshire and The Humber at 6.1% and the West Midlands at 5.8%.

The region with the lowest rate was the South East at 3.0%. The next lowest rates were seen in the South West at 3.1% and the East of England at 3.8%.

Figure 4: Claimant Count Rates, January 2013, Seasonally Adjusted

Download chart

-

XLS format

(17 Kb)

Local Authority Labour Market Indicators

For the period October 2011 to September 2012 the highest employment rate in Great Britain was Uttlesford in Essex at 86.1%. The next highest was Corby in Northamptonshire at 85.3% and Redditch in Worcestershire at 84.2%. The lowest rates were Birmingham at 56.6%, followed by London Borough of Newham at 57.2% and Blaenau Gwent at 58.5%.

For the period October 2011 to September 2012 the highest unemployment rate in Great Britain was Kingston upon Hull at 15.4%. The next highest was Middlesbrough at 14.9% and Blaenau Gwent 14.8%. The lowest rate was in West Dorset at 3.2% followed by Shetland Islands at 3.4% and Eden at 3.5%.

In January 2013 the local authority with the lowest proportion of the population aged from 16 to 64 years claiming Jobseekers Allowance in Great Britain was Mid Sussex at 1.1%. This was followed by Hart in Hampshire, North Dorset and Aberdeenshire at 1.2%. Nine local authorities had a proportion of 1.3%. It was highest in Kingston upon Hull at 9.0%, followed by Middlesbrough at 8.8%. A further eight local authorities had a proportion of 7.0% or more.

An interactive version of this map showing claimant count proportions by local authority over time is available. This map also shows claimant count proportions for males, females, 18 to 24 year olds and those claiming over 12 months.

In 2010 the highest jobs density in Great Britain was the City of London at 40.37 and the lowest was East Renfrewshire at 0.38. Westminster (3.33), Camden (1.72) and Islington (1.34), all in London were the next highest jobs densities. The highest jobs density outside London was Crawley at 1.26. After East Renfrewshire, the lowest jobs density was Lewisham in London at 0.39, followed by East Dunbartonshire at 0.40.

Index of Tables

LFS headline indicators (Employment, unemployment and inactivity):

Headline Indicators for All Regions (HI00) (6.93 Mb Excel sheet)

LFS headline indicators (Employment, unemployment and inactivity); Employment and Workforce Jobs estimates; Claimant Count; and Economic Activity and Inactivity estimates for each region are available in the following Tables:

Headline Indicators for North East (HI01) (2.27 Mb Excel sheet)

Headline Indicators for North West (HI02) (2.02 Mb Excel sheet)

Headline Indicators for Yorkshire and The Humber (HI03) (2.46 Mb Excel sheet)

Headline Indicators for East Midlands (HI04) (2.61 Mb Excel sheet)

Headline Indicators for West Midlands (HI05) (2.44 Mb Excel sheet)

Headline Indicators for East of England (HI06) (2.37 Mb Excel sheet)

Headline Indicators for London (HI07) (2.05 Mb Excel sheet)

Headline Indicators for South East (HI08) (2.02 Mb Excel sheet)

Headline Indicators for South West (HI09) (2.02 Mb Excel sheet)

Headline Indicators for Wales (HI10) (2.31 Mb Excel sheet)

Headline Indicators for Scotland (HI11) (2.42 Mb Excel sheet)

The following tables contain local labour market indicators for all regions:

Local Indicators for Unitary and Local Authorities (LI01) (246 Kb Excel sheet)

Local Indicators for Parliamentary Constituencies (LI02) (309.5 Kb Excel sheet)

Local Indicators for Constituencies of the Scottish Parliament (LI02.1) (115 Kb Excel sheet)

Local Indicators for Travel-to-Work Areas (LI03) (178 Kb Excel sheet)

Local Indicators for NUTS3 areas (LI04) (143 Kb Excel sheet)

The following tables contain local claimant count data for all regions:

Claimant Count by Unitary and Local Authority (JSA01) (258.5 Kb Excel sheet)

Claimant Count by Parliamentary Constituency (JSA02) (618.5 Kb Excel sheet)

Claimant Count by Constituencies of the Scottish Parliament (JSA02.1) (120.5 Kb Excel sheet)

Other tables:

Summary of Headline Indicators (S01) (72.5 Kb Excel sheet)

Sampling Variability and Revisions Summary (S02) (41.5 Kb Excel sheet)

Model Based Estimates of Unemployment (M01) (1.78 Mb Excel sheet)

Background notes

-

This Month’s Bulletin

From this month’s release, individual labour market statistics spreadsheets will only be published in months in which new and/or revised estimates are available. -

Next Month’s Bulletin

In next month’s Statistical Bulletin there will be revisions to estimates of workforce jobs. The most significant revisions will be caused by benchmarking to the latest estimates from the annual Business Register and Employment Survey (BRES); these revisions will go back to 2008.In the 2011 BRES, ONS reclassified those working owners of limited companies previously classified to self-employment jobs to employee jobs. In next month’s Statistical Bulletin, the workforce jobs estimates will come into line with BRES and all working owners of limited companies will be classified to employee jobs back to the start of the series in 1959. Information regarding the classification of working owners is available in an article published on the website (107.9 Kb Pdf) .

There will be further revisions to workforce jobs estimates resulting from:

• an improved methodology for linking short-term employment growth onto the latest BRES benchmark,

• a review of the seasonal adjustment process,

• bringing the estimates into line with the latest estimates of Public Sector Employment,

• reweighting of Labour Force Survey inputs using more up to date population estimates, and

• the introduction of estimates for Activities of Households as Employers, etc. (Standard Industrial Classification 2007 (SIC 2007) Section T).The introduction of estimates for Activities of Households as Employers, etc. will result in the introduction of a new series at Table 5 of the data tables HI01 to HI11.

ONS plans to publish an article to explain these developments in full.

-

Quality Issues

One indication of the reliability of the key indicators in this bulletin can be obtained by monitoring the size of revisions. These summary measures are available in the Regional Labour Market Sampling Variability spreadsheet (41.5 Kb Excel sheet) available with this bulletin and show the size of revisions over the last five years. The revised data itself may be subject to sampling or other sources of error. The ONS standard presentation is to show five years worth of revisions (i.e. 60 observations for a monthly series, 20 for a quarterly series).Further information on the Quality of and Methods for Work Force Jobs estimates can be found in Summary Quality Report (295.4 Kb Pdf) .

-

Other Quality information

Quality and Methodology Information papers for labour market statistics are available on the website. Further information about the Labour Force Survey (LFS) is available from:

· the LFS User Guide, and

· LFS Performance and Quality Monitoring Reports. -

Sampling Variability

Very few statistical revisions arise as a result of ‘errors’ in the popular sense of the word. All estimates, by definition, are subject to statistical ‘error’ but in this context the word refers to the uncertainty.Some data in the bulletin are based on statistical samples and, as such, are subject to sampling variability. If many samples were drawn, each would give different results. The ranges shown in the Regional Labour Market Sampling Variability spreadsheet (41.5 Kb Excel sheet) , available with this bulletin, represent ‘95 % confidence intervals’. It is expected that in 95 % of samples the range would contain the true value.

-

Interpreting Labour Market Statistics

There is an article on the website to help users interpret labour market statistics and highlight some common misunderstandings. A more detailed Guide to Labour Market Statistics is also available. -

Special Events

ONS has recently published commentary, analysis and policy on 'Special Events' which may affect statistical outputs. For full details go to the Special Events page on the ONS website. -

Details of the policy governing the release of new data are available by visiting www.statisticsauthority.gov.uk/assessment/code-of-practice/index.html or from the Media Relations Office email: media.relations@ons.gsi.gov.uk

The United Kingdom Statistics Authority has designated these statistics as National Statistics, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the Code of Practice for Official Statistics.

Designation can be broadly interpreted to mean that the statistics:

- meet identified user needs;

- are well explained and readily accessible;

- are produced according to sound methods; and

- are managed impartially and objectively in the public interest.

Once statistics have been designated as National Statistics it is a statutory requirement that the Code of Practice shall continue to be observed.

Statistical contacts

| Name | Phone | Department | |

|---|---|---|---|

| Bob Watson | +44 (0)1633 455070 | Regional and Local Data/Claimant Count | bob.watson@ons.gsi.gov.uk |

| Nick Palmer | +44 (0)1633 455839 | Regional and national Labour Force Survey | nicholas.palmer@ons.gsi.gov.uk |

| Emily Carless | +44 (0)1633 455717 | Workforce Jobs | emily.carless@ons.gsi.gov.uk |

© Crown Copyright applies unless otherwise stated.