Statistical commentary on non-domiciled taxpayers in the UK

Updated 29 July 2021

© Crown copyright 2021

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: psi@nationalarchives.gov.uk.

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/statistics/statistics-on-non-domiciled-taxpayers-in-the-uk/statistical-commentary-on-non-domiciled-taxpayers-in-the-uk

1. Summary of key statistics

The key findings from this year’s publication are:

-

In the tax year ending 2020, we estimate that there were 75,700 individuals claiming non-domiciled taxpayer status in the UK on their Self Assessment (SA) tax returns, down from 78,600 in the previous year. While we currently estimate a decrease this figure may be revised in the future and could show a reduced level of difference from the previous year.

-

Over the previous 3 years, following a change in policy in April 2017, the number of non-domiciled taxpayers has been stabilising at a lower level due to these taxpayers either becoming domiciled or no longer paying tax in the UK. This suggests the impact of this new deemed domicile policy has stabilised. The number of non-domiciled taxpayers who are UK resident has remained largely unchanged from the previous year.

-

We estimate that non-domiciled taxpayers are liable to pay £7,853 million in UK Income Tax, Capital Gains Tax (CGT) and National Insurance contributions (NICs) in the tax year ending 2020. We currently see a decrease from the previous year’s figure of £7,898 million, but if the current year’s figure is revised in the future (due to late submission of tax returns) the difference may reduce further.

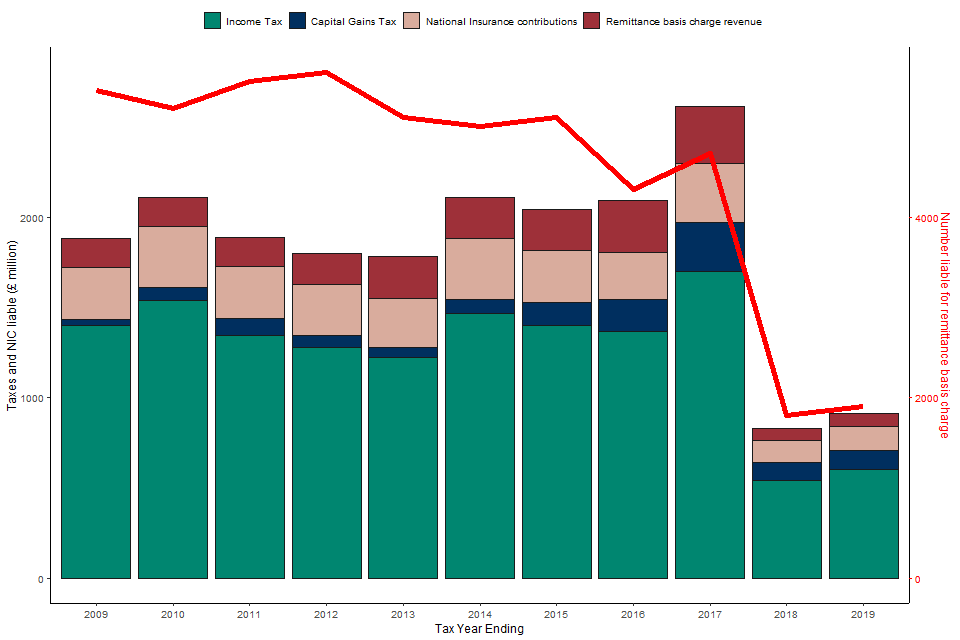

Figure 1: Non-domiciled taxpayer numbers, Income Tax, Capital Gains Tax and National Insurance contributions

2. About this release

This publication is the annual update of statistics on individuals who are non-domiciled for tax purposes. To qualify as a non-domiciled taxpayer an individual must have their permanent home, their ‘domicile’, outside the UK. They must also claim non-domiciled status in the UK for tax purposes on their UK SA tax returns. Figures for tax years ending 2018, 2019 and 2020 are provisional, all other figures are final.

3. Non-domiciled taxpayers and taxes

We estimate that there were 75,700 individuals claiming non-domiciled taxpayer status in the UK on their SA tax returns in the tax year ending 2020. This is down from 78,600 in the tax year ending 2019, but is a smaller decrease than that seen between the tax year ending in 2016 and the tax year ending in 2017 or between the tax year ending in 2017 and the tax year ending in 2018.

Those falls are largely explained by the deemed domicile reforms introduced in April 2017 which meant that an individual who was formerly non-domiciled might be deemed domiciled for tax purposes if they were born in the UK and have a UK domicile of origin (Condition A), or if they were resident in the UK for at least 15 of the 20 tax years immediately before the relevant tax year (Condition B).

Current analysis shows that these decreases in the number of non-domiciled taxpayers were explained by taxpayers either becoming domiciled in the UK or no longer paying tax in the UK. Despite the decrease in the number of non-domiciles this did not result in an overall fall in revenue to the exchequer, with those becoming domiciled continuing to pay tax in the UK, and the tax received from new non-domiciles offsetting those that no longer pay tax in the UK.

Figure 1 suggests that the impact of the deemed domicile reforms has stabilised, but further analysis is needed to provide full evidence. This would involve comparing those affected by the deemed domicile reforms to a similar set of non-domiciled individuals who were not affected by the reforms.

We estimate that in the tax year ending 2020, the amount of UK Income Tax, CGT and NICs liable by all non-domiciled taxpayers was £7,853 million. This is a decrease from last year’s estimate of £7,898 million. Overall, of all non-domiciled taxpayers in the tax year ending 2020, the majority claimed UK residence as in previous years.

We have provided provisional figures for the tax year ending 2020 for Tables 1 to 3 only (in the accompanying spreadsheet). Figures for tax year ending 2020 may be revised in the future and the difference between them and previous years may be reduced, or disappear. Further breakdown of the figures for the current year are not included as the source data is not complete enough to be a reliable indicator of trends (due to the level of similarity between two successive years of data) and will be included in next year’s publication. For the rest of this publication, we will discuss tax years up to tax year ending 2019.

4. Non-domiciled UK resident taxpayers, remittance basis and arising basis

The vast majority of non-domiciled taxpayers are UK resident. For the tax year ending 2019, in Figure 2, the number of UK-resident non-domiciled taxpayers fell from 65,000 to 64,700, compared with a fall from 79,500 to 78,600 for all non-domiciled taxpayers. The UK resident non-domiciled group is taxed on two bases: a remittance basis or an arising basis.

Individuals who are UK resident are normally taxed on the arising basis of taxation, so that all of that individual’s worldwide income and gains are taxable in the UK as they arise. Some non-domiciled taxpayers who are UK resident may choose to be taxed on the remittance basis, meaning that any foreign income and gains will be taxed if they are brought, or remitted, into the UK, even if that remittance occurs in a later tax year.

Those taxed on a remittance basis make up a larger proportion of non-domiciled UK residents. Figure 2 also shows that the number of taxpayers on both the arising and remittance basis have been broadly stable since the tax year ending 2018. This is another element that suggests stabilisation of the impact of the April 2017 policy change to introduce deemed domicile status.

Figure 2: Number of non-domiciled UK residents claiming the remittance basis or the arising basis of taxation

In Figure 3, non-domiciled UK resident taxpayers claiming the remittance basis of taxation on their SA tax return were liable to pay more, on average, in every tax year than those claiming the arising basis of taxation on their SA tax return.

Please note Tables 4 to 5 will not include some individuals who pay tax on the arising basis without claiming non-domiciled status on the SA return, in particular - taxpayers who were considered non-domiciled, but are now deemed to be domiciled and have moved onto the arising basis. The number of taxpayers on the arising basis and their taxes and NICs liabilities have also fallen in recent years, but may now be stabilising.

Figure 3: Total UK Income Tax, Capital Gains Tax and National Insurances contributions to be paid by non-domiciled taxpayers on the remittance basis of taxation and by non-domiciled taxpayers on the arising basis of taxation

5. Remittance basis and the remittance basis charge

5.1 Population changes

Figure 4 shows how the fall in tax year ending 2018 of the total number of non-domiciled UK resident taxpayers is reflected in a fall in the number of individuals liable for the remittance basis charge (RBC), and the total tax amount to be paid by those individuals in the tax year ending 2019.

Tables 6 and 7 show that a majority of the taxpayers who are using the remittance basis are not paying the RBC. This is because the RBC is only levied when a remittance basis user has been UK resident for at least 7 of the previous 9 tax years immediately before the relevant tax year.

5.2 Remittance basis claimants and taxes

Figure 4: Number of non-domiciled UK resident taxpayers taxed on the remittance basis and their Income Tax, Capital Gains Tax and National Insurance contributions

Non-domiciled taxpayers on the remittance basis in the tax year ending 2019 are liable to pay £6,398 million in Income Tax, CGT and NICs. This is an increase from 2018, but remains below the high point in the tax year ending 2017. As discussed previously, we believe further analysis will show this did not result in an overall fall in revenue to the exchequer, with those becoming domiciled continuing to pay tax in the UK, and the tax received from new non-domiciles offsetting those that may have left the UK and no longer pay tax in the UK.

The number of non-domiciled taxpayers paying on the remittance basis was 46,100 in the tax year ending 2018. We expect to revise this in future years due to a small number of late filers.

6. Remittance basis charge revenue

Figure 5: Non-domiciled UK resident taxpayers liable to pay the remittance basis charge and UK Income Tax, Capital Gains Tax, National Insurance contributions and remittance basis charge revenue

Figure 5 shows the number of taxpayers who were liable to pay RBC rose from 1,800 in the tax year ending 2018 to 1,900 in the tax year ending 2019, which is further explored in the section below alongside Figure 6. The total amount to be paid by taxpayers in Income Tax, CGT, NICs and the RBC also rose from £829 million from those who liable to pay the RBC in the tax year ending 2018 to £914 million from those who were liable to pay the RBC in the tax year ending 2019.

6.1 Remittance basis charge revenue and numbers

Figure 6 shows the change over time in the number of non-domiciled taxpayers liable to pay the RBC, grouped by amount of the charge in a particular tax year, and the amount of revenue generated by the RBC.

In April 2012 and April 2015 there were two separate changes to the remittance basis charges regime, followed by a change in April 2017 to deem individuals as domiciled where either of the two conditions were met. We believe the deemed domicile change explain the majority of the decrease in the number of individuals paying the RBC, as those individuals no longer have non-domicile status and are treated as domiciled.

The accompanying background quality review provides more details on the RBC and deemed domiciled changes.

Figure 6: Break down of non-domiciled taxpayers that pay the remittance basis charge by charge amount

7. Non-domiciled taxpayers by region

7.1 Regional observations

London had the largest non-domiciled taxpayer population in the tax year ending 2019, with 58% of non-domiciled taxpayers in the UK located in that region and 72% of UK Income Tax, CGT and NICs coming from that region. London also had the largest population of UK resident non-domiciled taxpayers, and the largest population of non-domiciled taxpayers on the remittance basis.

8. Business Investment Relief in the UK

Figure 7: Value of business investment relief and number of claimants

Figure 7 shows that in the tax year ending 2019 the cumulative value of investments in UK businesses on which Business Investment Relief (BIR) has been claimed, since BIR began in 2012, is £5,414 million. In the tax year ending 2019 alone, £1,031 million was invested in the UK from 500 taxpayers.