Climate Change Levy and Carbon Price Floor Bulletin commentary

Updated 10 June 2021

© Crown copyright 2021

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: psi@nationalarchives.gov.uk.

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/statistics/climate-change-levy-ccl-and-carbon-price-floor-cpf-bulletin/climate-change-levy-and-carbon-price-floor-bulletin-commentary

Climate Change Levy (CCL) declarations statistics and estimated separate CCL and Carbon Price Floor (CPF) receipts statistics from February to November 2020 should be treated with additional caution.

This is due to difficulties faced by taxpayers submitting returns during the coronavirus (COVID-19) pandemic.

CCL and CPF taxpayers should go to Submit returns for Climate Change Levy guidance for details about how to submit tax returns.

Headlines

The latest headlines for CCL and CPF statistics are:

- the provisional year to date (April to November) total for CCL and CPF receipts during the 2020 to 2021 financial year is £1,234 million, which is £201 million (14.0%) lower than the same period during the previous financial year

- the provisional year to date (April to October) total for CCL and CPF declarations during the 2020 to 2021 financial year is £735 million, which is £248 million (25.2%) lower than the same period during the previous financial year

- CCL receipts and CCL and CPF declarations for each fuel type have decreased from quarter 1 of the 2020 to 2021 financial year, potentially related to economic impacts caused by the coronavirus pandemic, but caution is advised due to the provisional status of the latest data

About this release

These HMRC National Statistics provide UK level statistics for CCL and CPF receipts and declarations by fuel type:

- electricity

- gas

- solid and other fuels, including liquefied petroleum gas (LPG)

It is not possible to provide accurate separate receipts statistics for CCL and CPF because taxpayers pay receipts for both as one. An estimate of separate receipts statistics for CCL and CPF is provided using taxpayer returns data and should be treated with caution.

Difficulties faced by taxpayers submitting returns during the coronavirus pandemic also means these statistics should be treated with additional caution from February to November 2020.

The latest release has been updated with provisional receipts data from December 2019 to November 2020 and provisional declarations data from November 2019 to October 2020.

The ‘Climate Change Levy and Carbon Price Floor Bulletin’ is Crown Copyright. The information contained can be used as long as the source is made clear by the user.

Total Climate Change Levy and Carbon Price Floor receipts and declarations

This section provides the latest total CCL and CPF receipts and declarations statistics.

CCL and CPF taxpayers mainly follow quarterly accounting periods. Tax returns are due by the end of the month following the accounting period. Payment of tax is also generally due to HMRC by the same time, but taxpayers who pay by direct debit are given a 7 day extension.

These accounting periods and payment patterns cause a 1 to 2 month lag between accounting periods ending and receipts being received by HMRC.

Users should not place too much emphasis on month to month changes for total declared or total receipts as these fluctuate due to the timing of reporting and payments. Quarterly totals provide more meaningful comparisons because of the quarterly stagger pattern.

If month on month comparisons are made, then each month should be compared to a prior month in the same stagger, such as April to January or April to April, rather than the previous month.

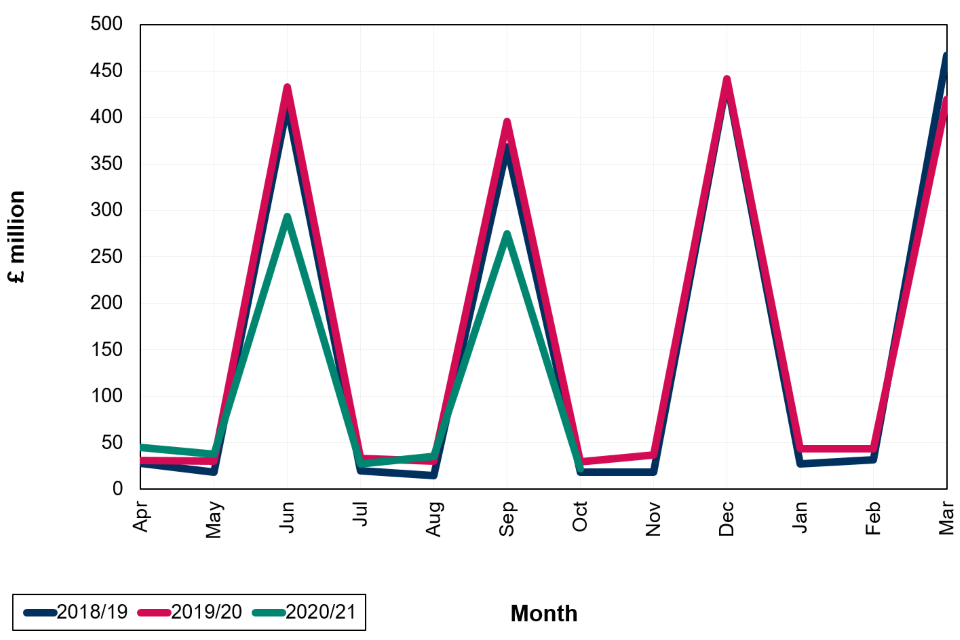

Chart 1: Climate Change Levy and Carbon Price Floor receipts by month (2020 to 2021 year to date alongside the previous 2 financial years).

Chart 1 demonstrates several trends for total CCL and CPF receipts:

- the provisional 2020 to 2021 financial year quarter 2 (July to September) total for CCL and CPF receipts is £344 million, which is £139 million (28.8%) lower than the same period during the previous financial year

- the provisional 2020 to 2021 financial year quarter 1 to quarter 2 (April to September) total for CCL and CPF receipts is £869 million, which is £142 million (14.1%) lower than the same period during the previous financial year

- during the previous 3 financial years, receipts during the 2019 to 2020 financial year were the highest, having followed a generally rising trend compared to 2018 to 2019, but receipts during the current financial year have decreased in comparison, potentially due to economic impacts relating to the coronavirus pandemic

Chart 2: Climate Change Levy and Carbon Price Floor declarations by month (2020 to 2021 year to date alongside the previous 2 financial years).

Chart 2 demonstrates several trends for total CCL and CPF declarations:

- the provisional 2020 to 2021 financial year quarter 2 (July to September) total for CCL and CPF declarations is £337 million, which is £122 million (26.6%) lower than the same period during the previous financial year

- the provisional 2020 to 2021 financial year quarter 1 to quarter 2 (April to September) total for CCL and CPF declarations is £713 million, which is £240 million (25.2%) lower than the same period during the previous financial year

- between the 2018 to 2019 and 2019 to 2020 financial years, total declarations followed a stable quarterly trend, but even though declarations have followed a similar quarterly shape during 2020 to 2021, declarations have been noticeably less, potentially due to economic impacts relating to the coronavirus pandemic

Chart 3: Climate Change Levy and Carbon Price Floor declarations by quarter and fuel type (2020 to 2021 year to date alongside the previous 2 financial years).

Chart 3 demonstrates several trends for total CCL and CPF declarations by quarter and fuel type:

- between quarter 1 and quarter 3 of the 2019 to 2020 financial year, there was a trend change in which electricity declarations increased above that of gas, likely following the removal of Levy Exemption Certificates (LEC) for electricity generated from renewable sources, alongside seasonal trends for gas as its use decreases during warmer seasons

- electricity declarations were increasing between the end of the 2018 to 2019 financial year and start of 2020 to 2021, but have noticeably decreased from quarter 1 of 2020 to 2021, potentially due to economic impacts caused by the coronavirus pandemic

- gas declarations have fluctuated in recent quarters, having noticeably decreased and recovered between quarter 1 and 4 of the 2019 to 2020 financial year, until like electricity declarations, gas decreased from quarter 1 of 2020 to 2021, potentially due to economic impacts caused by the coronavirus pandemic

- declarations for solid and other fuels have followed a consistent downward trend, likely reflecting declining quantities of coal used for electricity production in the UK

- although following a declining trend, declarations for solid and other fuels are noticeably larger during quarter 3 and 4 of financial years, likely due to increased use during colder seasons

Contacts

The CCL and CPF Bulletin is produced by the Indirect Tax Receipts Monitoring team as part of the ‘Excise duties, VAT, and other tax statistics’ collection.

For statistical enquiries, contact:

S Taylor revenuemonitoring@hmrc.gov.uk

For media enquiries, see HMRC press office.