Landfill Tax Bulletin Commentary (October 2020)

Updated 10 June 2021

© Crown copyright 2021

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: psi@nationalarchives.gov.uk.

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/statistics/landfill-tax-bulletin/october-2020-commentary

Released: 27 November 2020. Next Release: 28 May 2021.

1. About this release

The Landfill Tax (LFT) publication is released bi-annually and provides monthly statistics and information on landfill tax receipts and declarations on liability submitted by traders to HM Revenue & Customs (HMRC). New information includes receipts data from April 2020 to September 2020, inclusive. Further details can be found within accompanying Landfill Tax background and references and Landfill Tax rates.

2. Coronavirus (COVID-19)

Impacts from the coronavirus and public health measures in response are visible within changing trends to receipts collected for Landfill Tax since April 2020. This is caused by a mixture of changes to payment timings, policies affecting business and emerging economic impacts. It’s too early to unpick impact levels from each, but this should become clearer over time.

3. Landfill Tax

Landfill Tax is a tax paid by landfill operators on the disposal of material at a landfill site. The tax is passed onto businesses and local authorities through the gate fee for disposing of waste at a landfill. The tax aims to provide incentive for the diversion of waste from landfill to other less harmful methods of waste management such as recycling and incineration.

The tax is charged by weight. There are two rates; standard rate and lower rate.

- lower rate applies to inert or inactive waste.

- standard rate applies to all other taxable materials including all disposals at an unauthorised site.

With effect from 1 April 2020, the following rates apply:

- lower rate: £3.00 per tonne.

- standard rate: £94.15 per tonne.

Exemptions exist for dredging, mining and quarrying waste, pet cemeteries, material from the reclamation of contaminated land, filling of quarries and waste from visiting forces.

4. Receipts

4.1 Headlines

These are the main points to note in this bulletin:

- total year-to-date LFT receipts for the current financial year (April 2020 to September 2020) are £241 million, which is £73 million (23.4%) lower than the same period last year (April 2019 to September 2019).

- LFT receipts have been falling year-on-year since financial year ending 2014. This year we are seeing larger falls due to reduced economic activity relating to the coronavirus outbreak.

- the gradual decline in receipts (prior to the coronavirus outbreak) can mainly be explained by an increase in diversion from landfill through alternative waste treatment methods like incineration, and an increase in recycling and composting.

- the devolution of Landfill Tax to Scotland and Wales also contributes to the fall in receipts. Receipts from Scottish Landfill Tax (from April 2015) and Landfill Disposals Tax (from April 2018) are not included here from these dates as they are no longer administered by HMRC.

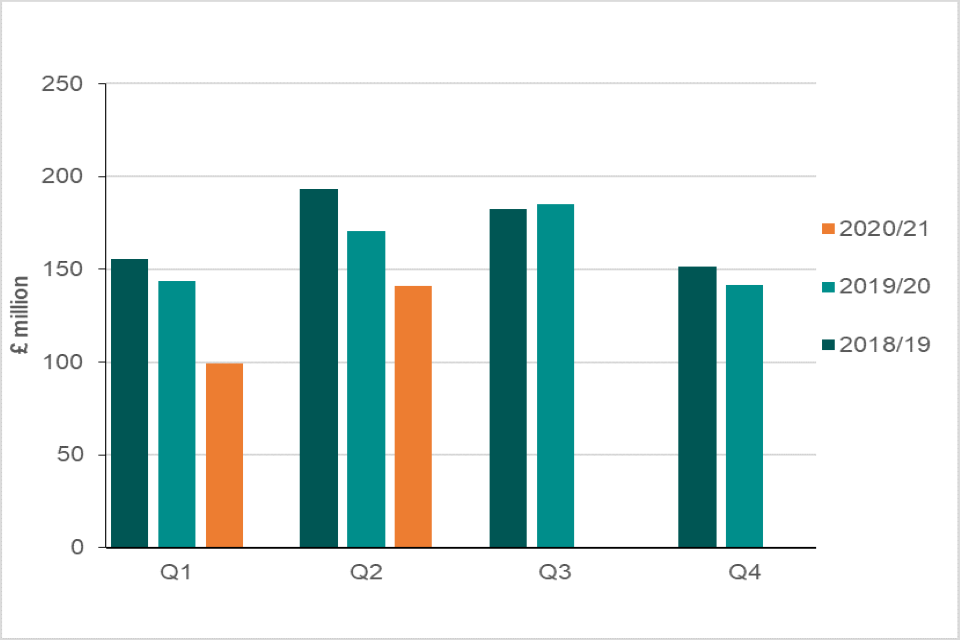

4.2 Chart 1: Quarterly LFT receipts for the past 3 financial years.

- total receipts in Q1 of this financial year were £44.2 million (30.8%) lower than the same quarter in the previous financial year.

- total receipts in Q2 of this financial year were £29.2 million (17.1%) lower than the same quarter in the previous financial year.

We have seen large decreases in receipts for Q1 and Q2 this financial year compared to the same quarters in the previous year. Whilst there has been a downwards trend in LFT receipts for several years, LFT receipts have been further reduced this year as a result of the coronavirus outbreak.

5. Quantity (tonnage) of waste placed in landfill

The principal objective of LFT is to provide an incentive to use alternative methods of waste disposal to landfill. The following chart shows the waste tonnage in landfill from quarter to quarter.

5.1 Chart 2: Standard rate, lower rate and exempt waste tonnage over the last 10 years.

- standard rate, lower rate and exempt tonnage all display fluctuations from quarter to quarter generally showing higher levels at Q1 and Q2 each financial year.

- standard rate tonnage has shown a steep downwards trend over the last 10 years, falling from 6.5 million tonnes in Q2 of the financial year ending 2011 to 1.8 million tonnes in Q2 of the financial year ending 2021 (a decrease of 72%).

- lower rate tonnage has shown a modest downwards trend over the last 10 years, falling from 2.6 million tonnes in Q2 of the financial year ending 2011 to 2.1 million tonnes in Q2 of the financial year ending 2021 (a decrease of 18%).

- exempt tonnage has shown greater fluctuation with a downwards trend over the last 10 years, falling from 2.2 million tonnes in Q2 of the financial year ending 2011 to 1.3 million tonnes in Q2 of the financial year ending 2021 (a decrease of 43%).

- total tonnage has shown a downwards trend over the last 10 years, falling from 11.3 million tonnes in Q2 of the financial year ending 2011 to 5.2 million tonnes in Q2 of the financial year ending 2021 (a decrease of 54%).

6. Credit claimed on trader returns

Traders can claim Landfill Tax credits if a landfill operator making contributions to local environmental projects that meet the requirements of the Landfill Communities Fund (LCF) scheme. As part of the LCF scheme traders can get tax credits worth 90% of the contribution made. The total credit mustn’t exceed that year’s maximum percentage credit and your contribution must be made to an environmental body that are approved and enrolled with ENTRUST, to be spent on an approved project.

6.1 Chart 3: Credit claimed on trader returns over the past 10 years

- credit claims are volatile from quarter to quarter.

- there has been a downwards trend over the last 10 years, falling from £13.7 million in Q2 of the financial year ending 2011 to to £8.2 million in Q2 of the financial year ending 2021 (a decrease of 43%).

7. Contacts

The Landfill Tax Bulletin is produced by the Indirect Tax Receipts Monitoring team as part of the ‘Excise duties, VAT, and other tax statistics’ collection.

For statistical enquiries, contact:

S Taylor revenuemonitoring@hmrc.gov.uk

For media enquiries, see HMRC press office.