Annual UK Annual Tax on Enveloped Dwellings statistics commentary

Updated 28 April 2023

About this release

This publication provides annual statistics on receipts and liable declarations for Annual Tax on Enveloped Dwellings (ATED). These statistics cover the whole of the UK. Data is split by price band, region, local authority, and type of relief. For key definitions, guidance and references see the published tables (spreadsheet) that accompany this document.

Background about annual tax on enveloped dwellings

Introduced in April 2013 to combat avoidance of Stamp Duty Land Tax, the annual tax on enveloped dwellings (ATED) is a recurring annual charge on UK residential property held in a ‘corporate envelope’ (a company for example).

How does ATED apply

ATED is a tax charged on ‘non-natural persons’ (typically companies) that own an interest in one or more UK residential properties valued above a certain amount. An ATED Return must be completed where:

The property is completely or partly owned by a non-natural person - that is, a company, a partnership where any of the partners is a company, or a ‘collective investment scheme’ (for example, a unit trust or an open-ended investment company); and is valued at more than:

-

£2 million, for returns from April 2013 onwards

-

£1 million, for returns from April 2015 onwards

-

£500,000, for returns from April 2016 onwards

The annual ATED charge is based on the value of the property on a fixed 5 yearly valuation date, or the price at acquisition if that was more recent. For the 5 financial year periods up to 2017 to 2018, the valuation date was 1 April 2012. For the 5 financial year periods up to 2022 to 2023 the valuation date was 1 April 2017.

Key summary

The headline findings in this annual report are:

- total ATED receipts in the 2021 to 2022 financial year were £119 million, increasing by 7% (£8 million) compared to the previous year, with the majority of price bands increasing compared to the 2020 to 2021 financial year. This is with the exception of the £500,000 to £1 million range which remained unchanged compared to the 2020 to 2021 financial year

- the 2021 to 2022 financial year is the first year since the 2015 to 2016 financial year in which ATED receipts have risen, following year on year consecutive falls

- the number of liable ATED declarations in the 2021 to 2022 financial year was 4,810, decreasing by 7% compared to the previous year, with decreases across all price bands compared to the 2020 to 2021 financial year

- the majority of ATED receipts are from London (85%), remaining unchanged when compared to the 2020 to 2021 financial year

- the local authority with the greatest share of ATED receipts in financial year 2021 to 2022 remains Westminster (48%), this is followed by Kensington and Chelsea (24%)

- the number of relief declarations made in financial year 2021 to 2022 was 22,910, increasing by 5% when compared to 2020 to 2021

- all types of relief declarations increased in financial year 2021 to 2022 compared to financial year 2020 to 2021, with the most notable rise being a 6% increase for Rental relief (accounting for 79% of all relief claims)

Estimated ATED receipts by band

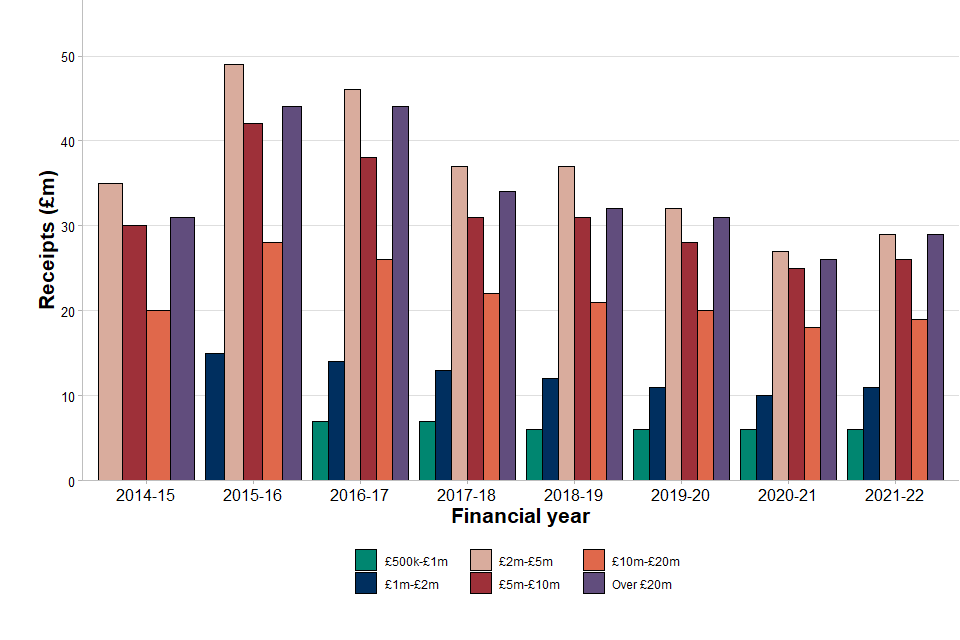

Figure 1 below shows the provisional figures of ATED receipts by property value band. Liable declarations include those which were liable for only part of the year, for example, when a property is sold.

Declaration numbers relate to the number of liable properties in the particular financial year, but receipts figures relate to the value of payments received in the financial year, rather than liabilities for the financial year.

Figure 1 shows that the majority of price bands increased compared to the 2020 to 2021 financial year. This is with the exception of the £500,000 to £1 million range which remained unchanged compared to the 2020 to 2021 financial year. This followed consecutive periods of falls across all valuation bands between financial year 2015 to 2016 and financial year 2020 to 2021.

Figure 1: ATED receipts by price band

Key points

The main findings for estimated ATED receipts by band are:

- total ATED receipts in the 2021 to 2022 financial year were £119 million, increasing by 7% (£8 million) compared to the 2020 to 2021 financial year

- in the financial year 2021 to 2022, receipts for the majority of price bands increased compared to the 2020 to 2021 financial year. This is with the exception of the £500,000 to £1 million range which remained unchanged compared to the 2020 to 2021 financial year

- the largest change across the price bands was a 12% increase for the Over £20 million price band

Estimated ATED liable declarations by band

Figure 2 below shows the provisional number of ATED liable declarations by property value band. Liable declarations include those which were liable for only part of the year, which can occur, for example, when a property is sold. The figure shows that the number of liable returns fall across all price bands for consecutive years since the 2016 to 2017 financial year. This trend is continued when comparing the number of liable returns in the 2021 to 2022 financial year to the 2020 to 2021 financial year.

Figure 2: ATED liable declarations by price band

Key points

The points below illustrate a breakdown of ATED liable declarations by price band:

- the number of ATED liable declarations decreased by 7% between the 2020 to 2021 financial year and the 2021 to 2022 financial year, from 5,190 to 4,810

- in financial year 2021 to 2022, the number of liable declarations decreased across all price bands compared to the 2020 to 2021 financial year

- the profile of liable declarations across all price bands remained relatively consistent when compared to the previous year

ATED receipts in the UK by countries and, within England, regions

Figure 3 shows the country and, within England, regional breakdown of receipts by percentage for eight financial years from the 2014 to 2015 financial year up to the 2021 to 2022 financial year. The geographical breakdown of receipts in the 2021 to 2022 financial year closely mirrors the breakdown in previous years. Though London remains the region with the largest percentage share of total ATED receipts, it’s percentage share has fallen consecutively since the 2014 to 2015 financial year.

Figure 3: ATED Receipts by region

Key points

The following points below illustrate a breakdown of total ATED receipts by country and, within England, region:

- receipts from ATED declarations for properties known to be in London accounted for 85% of all receipts in the 2021 to 2022 financial year, remaining unchanged, though significantly still the highest of all regions

- overall, the country and, regional breakdown appears broadly stable when compared to previous years; with the South East at 10% of all receipts, the East of England at 2%, the South West at 1%, Scotland at 1% and the combined rest of the UK at 1%

- it is not possible to provide a breakdown of receipts for all regions in the UK as this would breach HM Revenue and Customs (HMRC) policy on disclosure and taxpayer confidentiality

ATED receipts by local authority

Figure 4 shows the local authority geographical breakdown of receipts by percentage for eight financial years from the 2014 to 2015 financial year up to the 2021 to 2022 financial year. This shows that Westminster continues to dominate the percentage share of total ATED receipts, though that share has fallen in consecutive years since the 2014 to 2015 financial year, this is followed by Kensington and Chelsea (another London local authority).

Figure 4: ATED receipts by local authority

Key points

The points below illustrate the geographical breakdown by local authority:

-

ATED receipts where a geographical area was known continued to be highest within the London Borough of Westminster, accounting for 48% of ATED receipts in the 2021 to 2022 financial year, decreasing by 1 percentage point when compared to the 2020 to 2021 financial year

- a further 24% of receipts came from declarations in the London local authority of Kensington and Chelsea, increasing by 1 percentage point compared to the 2020 to 2021 financial year

- it is not possible to provide a comprehensive breakdown of receipts for all Local Authorities, or smaller geographies in the UK as this would breach HMRC’s policy on disclosure and taxpayer confidentiality

ATED relief declarations by type

There are a number of reliefs available which may reduce a non-natural person’s ATED liability to nil. These are claimed by stating on the ATED return the relief that applies. Any changes to the relief status of a property must be stated on a new return.

It is not possible to provide a breakdown of receipts for all relief claims in the UK as this would breach HMRC’s policy on disclosure and taxpayer confidentiality.

Figure 5 shows the number of ATED relief declarations for eight financial years from the 2014 to 2015 financial year up to the 2021 to 2022 financial year. This shows a year-on-year increase in relief declarations for all types of reliefs. As in previous years, Rental relief continues to dominate the type of relief being claimed.

Figure 5: ATED relief declarations by type

Key points

The main findings are:

- there was a total of 22,910 relief declarations in the 2021 to 2022 financial year, increasing by 5% compared to the 2020 to 2021 financial year (year on year comparisons on reliefs should be treated with caution, especially in relation to changes in the population that fall within the scope of ATED)

- all types of relief declarations increased in financial year 2021 to 2022 compared to financial year 2020 to 2021, with the most notable rise being a 6% increase for Rental relief (accounting for 79% of all relief claims)

- the next highest share of relief claims was the Developer relief accounting for 13%, seeing a 2% increase when compared to the 2020 to 2021 financial year

- the “Other” relief categories account for 8%, seeing a 1% increase when compared to the 2020 to 2021 financial year

Contact information

If you have any queries relating to this publication, please e-mail the stamp taxes inbox.

Please see the stamp duties statistics collection for all related statistics.